Green Dot is a reliable debit card provider that allows its users to manage and access their money whenever they need it. It allows its users to get a prepaid card without a credit check. The green dot app offers the facility of paying and receiving money from anywhere in the world.

It also offers the facility of 3% cashback on multiple transactions from online or in-app purchases. It offers its training in the form of documentation and videos to facilitate its new users. It provides mobile support for Android and iOS. Financial needs can also be fulfilled by using Green Dot.

For the ease of customer’s green dot card services, which include the monthly fee of $7.95. This card can also be used for online shopping, checking balances, making transactions, and withdrawing money from ATMs. It is operated under the green dot banks and Bonneville Bank.

It includes the features of Tax Refund, Deposit Cash, Bank Deposit, Online Banking, PayPal Cash Loading, Tax Alerts, and many more. It is an online bank that offers the facility of unlimited cashback rewards through its spending accounts.

Why Do Users Want Green Dot Alternatives?

Green Dot is offering the best services of debit card that allows users to get a prepaid card without any credit check. It offers good solutions for those customers who want more control over their spending without using traditional bank services, and green dot’s customer service is quite responsive.

It also has some shortcoming that hinders the users from using it in multiple places as its transaction limit is only up to $2500.00. So, you have to access other platforms if you want to make higher transactions. It also includes some hidden charges and its cash transactions are difficult and very much expensive.

List of Incredible Green Dot Alternatives

Green Dot is helpful in providing the services of a debit card without checking the credit. To use this application, simply make an account on it and get an email about the green dot login. It is used for online shopping, making transactions, checking balances, and withdrawing money from ATMs.

In regard to these best functionalities, the following Green Dot alternatives are selected and explained thoroughly, along with their structure and working techniques. An explicit comparison is also provided, which helps the audience in choosing the best possible alternative for Green Dot.

1. Payoneer

Payoneer is an international money transfer market that is mainly used for local and international transactions. It is helpful in sending and receiving the payment directly to a bank account in the form of local currency. It offers its services to almost two hundred countries.

It includes the core features of free receiving payments, low conversion fees, local currency, and many more. Users will also be able to send and receive payments from Payoneer users and from third parties also who don’t have Payoneer accounts.

It offers multiple methods of transferring payments like MasterCard, bank transfer, and e-Wallet. Its typical customers are Small and Mid-Size Businesses, Large Enterprises and, Freelancers. It is basically a financial service provider, not an all-in-one payment service provider like PayPal.

Features

- Risk Management

- Professional Services

- API Supported

Pros

- Safe and Secure

- Faster Payment

- Quick Access

- Easy to Use

Cons

- Delays in Payment

- Poor Customer Support

- Difficult Verification Process

- Problems in MasterCard

2. Prepaidify

Prepaidify is an online money transfer service used to buy gift card brands from certified retailers. It offers an easy, affordable, and secure way to manage users’ money and finance. One Prominent feature is that it has an international calling number while the green dot phone number is for specified regions.

It offers the facility of depositing cash in prepaid cards from any retailed location along with paychecks or government benefits. Customers will also be able to get digital code for gifts 24/7 through email by using this platform. Instructions will also be given along with the gift cards.

Features

- ATM Withdrawal

- MoneyGram Deposit

- Western Union Deposit

- Secured Card Payments

Pros

- User-Friendly Interface

- Easy to Use

- Safe and Protected

- Online Shopping

- Support Multiple Location

Cons

- Scam Alert

- Risky to Use

- Poor Customer Service

3. NetSpend

NetSpend is a mobile application that offers the services of MasterCard and Prepaid debit cards to its users in order to manage their accounts whenever they need them. It allows its users to check the current balance and transaction history of its users at any time they want.

It is helpful in sending money to friends and family, reloading locations, and loading balances to account. It has a user-friendly interface that is easy to use and is quite fast and secure. It provides the mobile support of Android and iOS and includes prepaid debit cards along with the maximum balance of cards.

Features

- PayPal Transfer

- Personalized Card

- Direct Deposit

- Card Account Transfer

Pros

- Can Refund Tax

- Transaction Alters

- Paying Online Bills

- Transaction History

Cons

- Limited Gift Option

- Issues in Transaction

- Risky in Payment Return

4. Card

Card is the financial management application that allows its users to deposit their checks along with images and is used to check the current balance without having a login. It has a user-friendly application that contains all the necessary features to be used as the standard Visa or Master debit card.

It offers the facility to accept checks, payments, and money and is also helpful in making ATM withdrawals. It includes the special security feature of fingerprint login that helps the users in protecting money. It includes the core features of Push notification, fast transaction, and sharing funds.

It is a little bit different from other applications but contains all the necessary options to manage financial services. It includes the feature of direct deposit and has a maximum deposit limit of $15000.00. It offers its facilityy of transaction and customer support 24/7.

Features

- Secure Online Shopping

- Direct PayPal Deposit

- Mobile Applications

Pros

- Support Multiple Locations

- User-Friendly Interface

- Easy to Use

- Zero Overdraft Fee

Cons

- Problems in Sharing Funds

- Issues in Checking Deposit

- Slow Processing

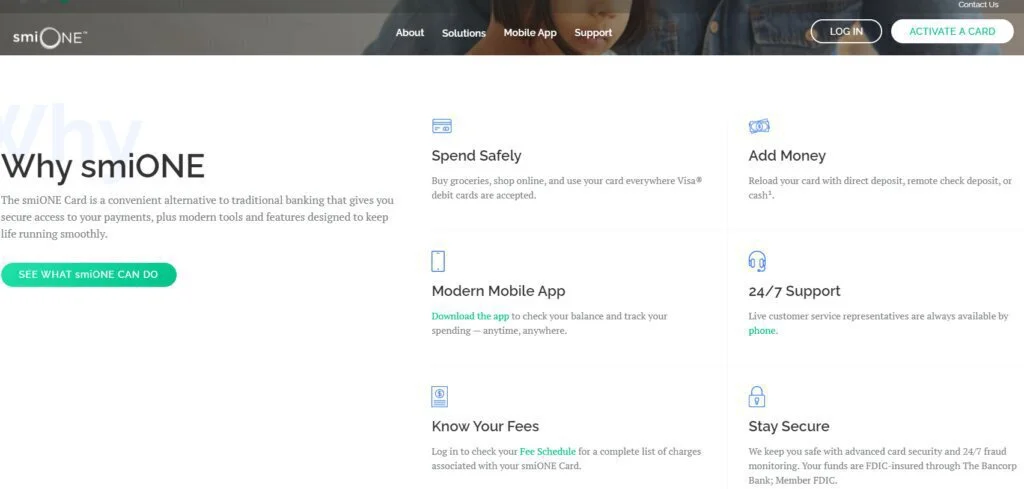

5. smiONE

smiONE is the standard prepaid debit card that can easily be used at the place of a Visa debit card. It is available in a mobile application that allows its users to view current card balance, spend patterns, and their activities easily from their mobiles or other devices.

Simplified and streamlined payment processing solutions have been provided by using this debit card. Its registered number is available for multiple purposes, while the green dot register number is only used to activate the card. It has a user-friendly interface that allows its users to get new cards.

It is helpful in giving access to its customers, and users will be able to make transactions anytime and from anywhere worldwide. It has a free application and easily available on the Google Play Store. It provides the mobile support of Android and iOS and offers a direct deposit facility.

Features

- Payroll Management

- Online Access

- Worldwide usage

- MoneyGram Transfer

Pros

- Highly Secured

- No Fees on Withdrawal

- Support Mobile Application

- Convenient to Use

Cons

- Limitations in Platinum Cards

- Problems in Sending Payments

- Poor Customer Support

6. Bluebird

Bluebird is a dynamic platform that gives all the control of money to its users. It offers the facility to manage money with ease and comfort. The best part of this platform is that it neither includes any hidden fee nor it contains any monthly fee for its services. It also provides the mobile support of Android and iOS.

It is helpful in sending money to friends and family with ease and comfort. It allows its users to receive money from any person in a smooth way. It also offers complete security to all of its user’s accounts from online threats and frauds. Instant vie of direct deposits can also be viewed by using this application.

Features

- Mobile Check Deposit

- Financial Management

- Entertainment Access

- Global Assistance

- Amex Offers

Pros

- User-Friendly Interface

- Mobile Support

- Fraud Protection

Cons

- Problems in Sending Money

- Security Issues

- Delay Payment

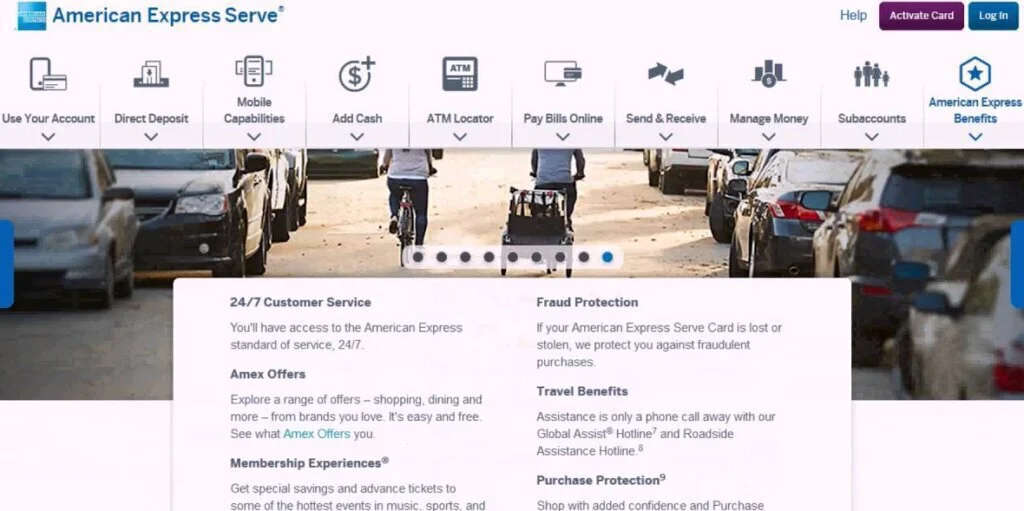

7. American Express Serve

American Express Serve is the platform that is used to manage the payments of its users in the better and most smooth way. It is helpful in sending digital cash to friends and family without any limitation. It allows its users to purchase the product online directly from the stores without paying physical cash.

It is also used to track all the transactions easily directly from the account. It does not offer any hidden charge or any extra amount for all of its services. It is also helpful in providing protection to its user’s accounts from online fraud. No additional charges should be paid by users in receiving money from other accounts.

Features

- Unlimited Cash Back

- ATM Withdrawal

- Setup Reserve Money

- Reloading Cash

Pros

- Foreign Transaction

- Online Bill Payment

- Direct Deposit

Cons

- Problems in Depositing

- Issues in Reloading Cash

- Limited Reserve Money

8. RushCard

RushCard is the prepaid visa debit card that allows its users to connect with the internet and can earn up to 3% cashback. Online shopping, accepting payments, cash withdrawal can also be possible by using this platform. It is also used for the investment process, and users get their profit on a monthly basis.

It provides the mobile support of Android and iOS. Users will also be able to view their current balance and transaction through the mobile text. It offers the facility of paying bills either online or offline. It allows its users to set up different saving goals for the purpose of saving money.

Features

- Online Billing

- Access ATM

- Direct Deposit

- Unlimited Signature

Pros

- Email Alerts

- Fraud Detection

- Support Multiple Location

- Easy to Use

Cons

- Issues in Remote Access

- Inaccurate Results

- Delay Payment

9. PayPal PrePaid

PayPal Prepaid is the best-in-class prepaid card that allows its users to eat, drink, and shop anywhere and anytime without paying physical cash. This card can be purchased online without paying any kind of fee. It is helpful in transferring digital cash from PayPal Account to any other PayPal Prepaid Cash Account.

It manages users’ accounts and can also be used to check the balance quickly. It allows its users to view the complete account details, including date, time, receiver ID, and many more. It also charges an additional transaction fee in sending and receiving money from other cards.

It is also helpful in providing protection to users’ accounts from online threats and is also used to save the account from fraud detection. Its customer service number is quite proactive, while on the other hand green dot customer service number is comparatively slow and unprofessional.

Features

- Direct Deposit

- Reloading Funds

- Instant Transfer

Pros

- Real-Time Activity Alerts

- Mobile Support

- Online Shopping

- Transaction History

Cons

- Issues in Referring Friends

- Problems in Loading

- Limited Resources

10. AccountNow

AccountNow is the financial service company that offers MasterCard and Visa prepaid accounts to all of its users who are fed up with traditional bank accounts. These cards are issued by MetaBank or The Bancorp Bank. Some simple steps need to follow to send money to this account.

First, select the “Share Money” option and then put the AccountNow card number in it. After that, enter the desired amount which is to be transferred. It is also helpful in checking the current balance quickly and is used to do online shopping from any time and anywhere in the world.

Features

- Unlimited Cash Back

- ATM Withdrawal

- Setup Reserve Money

- Pin Transaction

Pros

- Online Billing

- FDIC Insured

- Support Mobile

- Direct Deposit

Cons

- Issues in Payment

- Security Problems

- Hidden Charges in Purchasing

11. Mango Card

Mango Card is the smart application that offers the smart way to pay for travel fares and gives 25% off no matter how often users travel. It is helpful in managing all the cash fares of passengers in a digitalized way without any difficulty. It offers no interest charges or any hidden charges on any kind of transaction.

It also allows its users to send and receive money from friends, family, and others. It helps its users to get complete detail about the transactions and current balance. Multiple deals like food, wine, dining, shopping, and sports can also be enjoyed by using this application.

It also provides security to users’ accounts and helps to prevent the accounts from online threats and fraud detection. To use its services, simply go to the account page and then select bank card users want to use and then enter the desired amount.

Features

- Fresh Cash Load

- Avoidable Monthly Fee

- High Yield Saving Account

- Rewards of Cashback

Pros

- User-Friendly Interface

- Convenient to Use

- Easy to Navigate

- Directly Deposit

Cons

- Issues in Activation

- Problems in Fraud Detection

- Limited Resources

12. Kaiku

Kaiku is an investment and smart matchmaking platform for early-stage venture funds. It helps the startups across the early stage and is very hard to access in making the journey to “investment readiness.” It includes 300 venture funds across 50 countries in order to support cross-border funding.

The VC process can be streamlined and become more data-driven with the help of network feedback and artificial intelligence. It offers global dead-flow opportunities to get the license of the organization. It includes a smart matchmaking algorithm for direct access to ventures.

Features

- Fund Raising

- Legal Documentation

- Resource Management

- Startup Funding

Pros

- Best for Investors

- No-Code Workflow

- Matching Algorithm

- Detailed Startups

Cons

- Limited Resources

- Expensive to Use

- Less Referral Commission

13. Walmart MoneyCard

Walmart MoneyCard is a prepaid card used to pay online bills, pay rent, sopping from stores, and many more. It helps the users in getting MoneyCard back easily with no credit check and no bank account requirements. It includes the features of transaction security, free ATM withdrawals, and easy money load.

It provides the mobile support of Android and iOS that helps the users to monitor and manage all of their things regarding payments. Unlike green dot bank, it offers the facility of debit card service to shop online or in-store everywhere from the world.

Features

- Cashback Reward Balance

- Deposit Checks

- Pre-Authorized Paper Check

Pros

- Easy Sending Money Process

- Mobile Check Deposit

- Reloading Cash Facility

- Support Mobile Application

Cons

- Issues in Debit Card

- Problems in Managing Payments

- Limited Reserve Balance

14. AchieveCard

AchieveCard is the standard debit card that is helpful in managing all the user’s money in a convenient and digitalized way. It helps in paying online bills and government challans without any effort. It offers instant views of transaction history and complete information about the user’s account.

It let its users check the balance anytime and anywhere in the world with the help of the internet. It is also useful in saving money and is helpful in providing protection to accounts against online threats. It includes different functionalities like online payments, shopping, and many more.

Features

- Direct Deposit

- Cashback Rewards

- Available Worldwide

Pros

- Online Bill Payment

- Support Multiple Retail Location

- Free Reloading

- No Hidden Charges

Cons

- Expensive Maintenance Fee

- Inquiry Balance Fee

- Currency Exchange Issues

15. ACE Elite

ACE Elite is a prepaid debit card that is helpful in managing and spending money without the tension of carrying cash at stores or restaurants. It provides multiple reload centers at multiple locations. It is also used to check the current balance and the transaction history at any time and anywhere worldwide.

It let its users send money to all of their friends, family, and others. It takes 3 to 5 minutes for approval, and an additional transaction fee is also applied for its funding. It is considered s the fast and secure method for transactions and is available in a lot of countries. It also provides the mobile support of Android and iOS.

Features

- No Cash Withdrawal Fee

- Support Mobile App

- Notification and Alerts

- Faster Reloading

Pros

- Direct Deposit

- Time-Saving Payment

- Maximum Load Limit

- Easy Access to Paychecks

Cons

- Hidden Charge

- High Expensive Monthly Fee

- Charges for Reloading

- Manual Reload Procedure

Final Words

Green Dot is a reliable debit card provider that allows its users to manage and access their money anytime they need it. The greendot bank is an online bank that offers unlimited cash-back rewards to all of its users. It is also helpful in sending and receiving the money to friends, family, and others.

Moreover, tax can also be refunded by using a green dot card and is used for PayPal cash loading. The main drawback of using this card is that is transaction limit is only up to $2500.00. It also includes some hidden charges, and its cash transactions are also difficult and very much expensive.

Many other alternatives are available that perform better than Green Dot and cover all its issues. As shown in the article, BlueBird and Payoneer are best to use because of their extensive features. However, the audience may choose other ones by considering their demand and available resources.