Today, as our expenses are increasing day by day, everyone is trying to save money to use in case of any issue or problem, and it is quite easy to use cash by logging in to your bank account. But due to any reason, you run out of your budget and want to borrow money from other people in case of an emergency.

For that purpose, it isn’t easy to go to the bank and apply for a loan, and that is why because of technological advancement, you can get money without any effort through different Apps like Solo Funds.

The Solo fund is a Candian app designed in 2015 by Rodney Williams and Travis Holoway. With this app, you can easily borrow or lend money through your smartphones without going anywhere. You have to request the amount of money you want, and after a few working days, your funds are credited to your bank accounts.

Moreover, Solo funds and other apps like Solo funds cover your emergency expenses without any interest. In addition to this, you can also get other benefits with Solo funds like it does not require any background check, your loan is not based on credit scores type of factors, and loans are granted within an hour.

People are now moving towards Solo funds and other apps like solo funds because it gives you an amazing opportunity to get a loan without high-interest rates. Also, it is an easy app that can be installed on any Operating System like Android or iOS.

Why Do You Want More Apps Like SoLo Funds?

People want different apps like solofunds because the solo fund is one of the best apps used worldwide. But it also has some disadvantages. It does not guarantee that you can immediately get the lander for a loan. Moreover, it also requires higher fees for smaller loans. Besides that, if you do not give the loan back within a time, solo scores go down. For that reason, people are moving towards other apps like solo funds.

It is not a good decision to get a loan on your future earnings as interest can become expensive day by day. The exact loan repayment time is often unclear, which is why chances of interest and other charges increase.

List of Incredible Apps Like SoLo Funds

Here we discuss the best apps similar to solo funds that help you lend and borrow money. These apps are mentioned below so let’s have a look at these amazing apps like Solo Funds.

1. Brigit

Among other apps like Solo funds, it is said to be the amazing app with which you can get free instant advance cash of 250$ that you can save also. Moreover, you can also get your credit scores without any credit approval or credit check. With these credit scores, you can get a loan for cars, homes, etc. In addition to all this, this app offers you a period of 1 to 2 years to return your loan, and you can also return early.

Furthermore, you can also monitor your credit scores and get a full credit report. Moreover, it also provides you with advance cash without any interest in any emergency. With this app, you can manage your finances and change your lifestyle as you can get more knowledge about yourt spending habits and gives you information about how much money you have to save to keep control of extra expenses.

Features of Brigit

- Everyone can use it because it is free of cost app.

- Enable you to monitor your credits.

- Send you alerts about upcoming bills to control your budget.

- Offers you much time to return the loan.

2. Prosper

If you want to get the best apps like solo funds, consider Prosper to be the one. It is said to be the peer-to-peer lending service with which you can get a loan with the best credit scores. This app has a rating system to get credit history or debt-to-income ratio for approving applicants for the loan. Moreover, if you want to get a loan, you have to pay a starting fee of 2.41%, which can be changed after the loan is approved.

Among other apps like solofunds, you also have to pay charges in this app if you do not return the loan within 15 days. If you have a bad credit score, we do not suggest using this app because its minimum standard is 640. In addition to this, after applying for the loan, you can get a loan within 2 to 3 working days. Moreover, you also have to pay monthly browser payments according to the interest, principles, etc.

Features of Prosper

- You can get a loan amount of 2000$ to 40000$.

- Gives you an option to apply for the loan as a joint applicant( two members).

- Provides you Auto invest option to review, set up, or adjust portfolio distributions.

- Enable you to get a 3 to 5-year policy to pay the loan back.

- Get a home equity line of credit in countries like Alabama, Colorado, etc.

3. Zirtue

It is another third-party app, among other apps like solo funds for Android. With this app, you can get a loan from your friends or family through legal means. Generally, it does not gives you a loan directly but is used as a third-party application. You have to set the amount of money you want, and the lender can make repayment policies according to their desire.

If both the parties agree to the policies, then the request is sent to this app and gives .loan payment at the desired time. Moreover, you can also monitor your details via this app. The secure free digital app is to set custom loan amounts or choose direct-bill.

The working of this app is simple as you can send a request to one of your contacts to get a loan. You can also select a repayment date suitable for you as it enables you to set a payback period from 3 to 36 months.

Features of Zirtue

- Allow you to set a custom amount of loan and also repayment time.

- You can set payment terms and also allow you to get automatic payments.

- Track your loan and payment amount.

- Secure and reliable platform.

4. Kiva

If you want to get the best apps similar to solo funds, consider Kiva to be the one that is quite different from other apps like solo funds. This app helps people by giving them a loan if they are low-income new businessmen via the internet. You can use this app in over 77 countries. You can see the personal stories of each person who applies for the loan, and you can select any of them to whom you want to give a loan.

This app works with 300 plus institutions and non-profit organizations. Allow you to search for the entrepreneur by browsing their profile and sending them a loan via PayPal or another bank account. With this app, you can also get the sum of loan capital of individual lenders and transfer it to the appropriate field. Moreover, you can get higher interest in loans from microfinance instituations.

Features of Kiva

- Provides you a loan of a minimum of 25$.

- Can be used by everyone because it is free of charge app.

- Allow you to categorize loans based on regions.

- Simple to navigate without any compromise on details.

5. Possible: Fast Cash & Credit

Another best online lender app, among other apps like solo funds, allows you to pay back the loan in installments, as you can get eight weeks to pay the loan, so you do not have to pay the full amount simultaneously. It provided you with simple methods to apply for a loan and said it to be one of the best apps like solofunds. This app does not allow any credit checks, so any bad credits accounts can also browse.

Moreover, you can not access this app in every country as it is available in limited countries. Before applying for the loan, you have to check the requirements of possible finance are compatible because this does not work with all banks.

You can get a notification within 24 hours after applying for the loan regarding whether the status of your loan is processed or not. Furthermore, you can also change the repayment loan date according to your desire.

Features of Possible: Fast Cash & Credit

- Send money directly on your Debit card for easy access.

- Provide you with more flexible cash options according to your need and want.

- Use this app in various places like Indiana, Missouri, California, etc.

- Allow you to repay the loan in installments.

6. MoneyLion

It is one of the best financing apps like solo funds and provides various features. With this app, you can get advance cash, check your accounts, track your records, give you personal loans, manage investments, etc. It is said to be all in one app, among other apps like solofunds that provides you several products. You can use this app to get advice about how you can spend your money. You can also get small loans to manage your monthly expenses.

Moreover, if you use this app for shopping, it also offers cashback. You have to create an account and add free services like Instacash advances to get a loan of up to 1000$. This payment can become higher according to the amount you borrow, as it ranges from 5.99% to 29.99%.

Furthermore, you can also predict possible costs via the Monthly Repayment Calculator. It enables you to pay back your loan within 12 months. You can also change your payment schedules according to your ease.

Features of MoneyLion

- It is said to be a free app, and anyone can create an account on it.

- Provide you with the tips on cash advances amount.

- Also provides you membership plan for your ease.

- Do not perform credit checks.

7. Lenme

It is said to be one of the amazing apps similar to solo funds that allow you to get funds and gives funds without high-interest rates. Also, this app enables you to maintain staff, manage loans and verify borrowers or lenders. You have to request a loan, and this app provides you with the best interest rates that match your profiles.

Moreover, you can get an easy-to-use interface as you have to create an account on this app and give some of your personal information along with the payment period. It allows you to get $5000, and you can also get the credit risk score as a green(strong credit), orange(moderate credit), red(high risk), etc.

After selecting the loan amount, you can also select the interest rate and return time, and as a lender, you have a right to accept or decline the offer. Moreover, this app does not charge investor fees but charges borrowers’ origination fees.

Features of Lenme

- You can get a loan easily directly with borrowers.

- Get the loan amount on your account directly within a week.

- Provides you an option to manage your repayment methods.

- You can install it via Google Play Store.

8. LendingClub

It is another best app among other apps like Solo Funds that give you various financial products and services. With this app, you can create unsecured personal loans between 1000 to 40000$. If you are a borrower than by getting a loan, your credit score would be 500 with three years of credit history.

If you want to apply for a loan. In that case, you have to explain why you want to get a loan and provide personal information like phone numbers, email addresses, and other users’ personal information. After approval of the loan, it now depends upon the lender whether to give you a loan or not. Moreover, if you have a low credit score and high debt, we do not suggest this app.

Features of LendingClub

- Enable you to start this app by adding an online banking username and password.

- Enable you to make direct-to-customer loans.

- Allow you to check your account balance.

- Create a budget and track your spending.

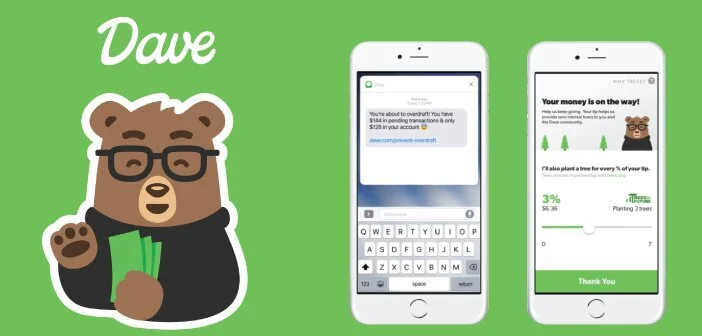

9. Dave

It is said to be another best app among apps like Solo Funds, with which you can get a small amount of loan for personal needs like groceries, etc. You can get a spending account with no fees for overdrafts. You have to pay for monthly fees of the app rather than the interest, and it is up to you to pay tips for services.

It is one of the cheaper apps like solofunds and can be used in emergencies. Moreover, this app can not analyze your credit reports, so low credit scorers can also use this app. Furthermore, if you do not pay your loan amount within the due date, this app automatically cuts that amount from your linked bank.

Features of Dave

- You do not have to give any interest.

- Does not provide an option of credit check.

- Advise you about how to save money.

- Provides tools for budgeting.

10. Avant

If you want to get a loan for your personal need, consider this app because it is one of the best apps like solo funds that give you a loan in case of a low credit score. This app provides you with money immediately in an emergency within 24 hours. Moreover, you can also get a maximum loan repayment time of 60-months and a minimum of 2 years.

Furthermore, you can get a loan amount of about 2000$ to 35000$, and lenders provide you with the best options for consumers with good credit scores. Moreover, you can also get a payment history, which enables you to calculate repayment amounts, set up recurring payments, and many more options.

Features of Avant

- Provides you with a huge loan amount for your ease.

- Give you a Quick funding option.

- Provide you with easy loan management.

- The lender offers competitive rates.

- Require maximum revenue.

11. Funding circle

It is another faster app, like solo funds, that provides you with a secure interface. You can get a cash advance in case of emergency depending upon your products and allow you to get a maximum of 5000$ to 500000$. Moreover, you have to pay interest on this app annually.

Moreover, the funds offered for a loan can be extended because this app is competitive. For getting a loan, your business must be at least two years old, and credit scores should be at least 660. In addition to other apps like solofunds, this app is said to be the fastest app for which you would not need minimum yearly revenue to qualify.

Features of Funding circle

- Offers invoice factoring.

- Does not require any prepayment penalty.

- Provides you with a large loan amount.

- Allow you to pay back the loan in 3 months or ten years.

Final Words

If you need money in emergencies, then avail bugs free apps like Solo funds, and keep in mind that many fake apps on the internet do not require any paperwork. Moreover, these apps make it easier for you to get a loan. We discussed some of the amazing apps like solo funds, with which you can get a loan in less time without huge interest. If you like this app, then share it with others too.